ISR (In-payment Slip with Reference number)

The ISRs are payment slips used in Switzerland. You can print them directly from Odoo. On the customer invoices, there is a new button called Print ISR.

Совет

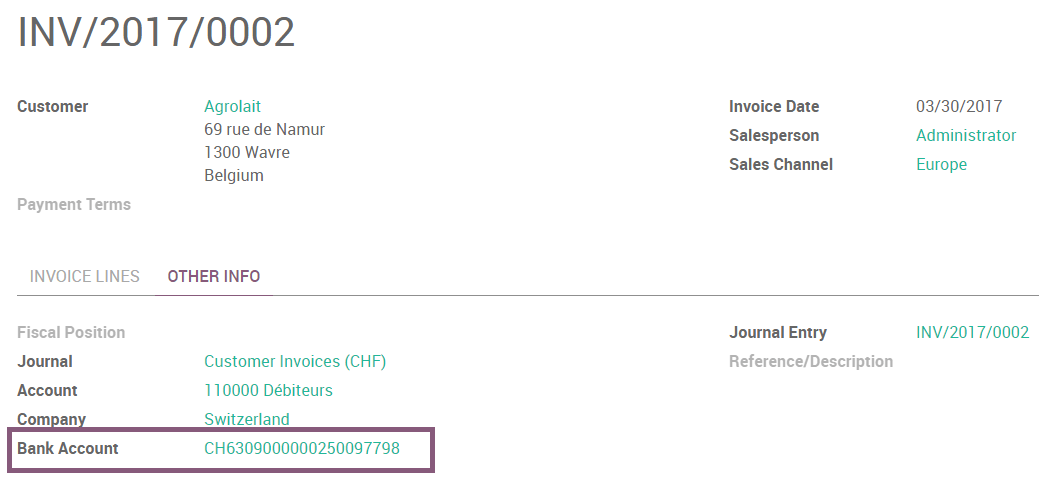

The button Print ISR only appears there is well a bank account defined on the invoice. You can use CH6309000000250097798 as bank account number and 010391391 as CHF ISR reference.

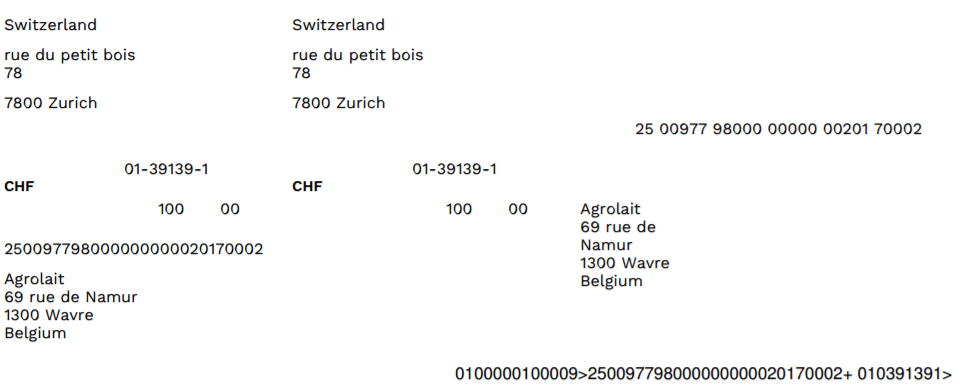

Then you open a pdf with the ISR.

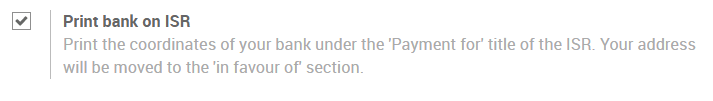

There exists two layouts for ISR: one with, and one without the bank coordinates. To choose which one to use, there is an option to print the bank information on the ISR. To activate it, go in and tick this box :

Currency Rate Live Update

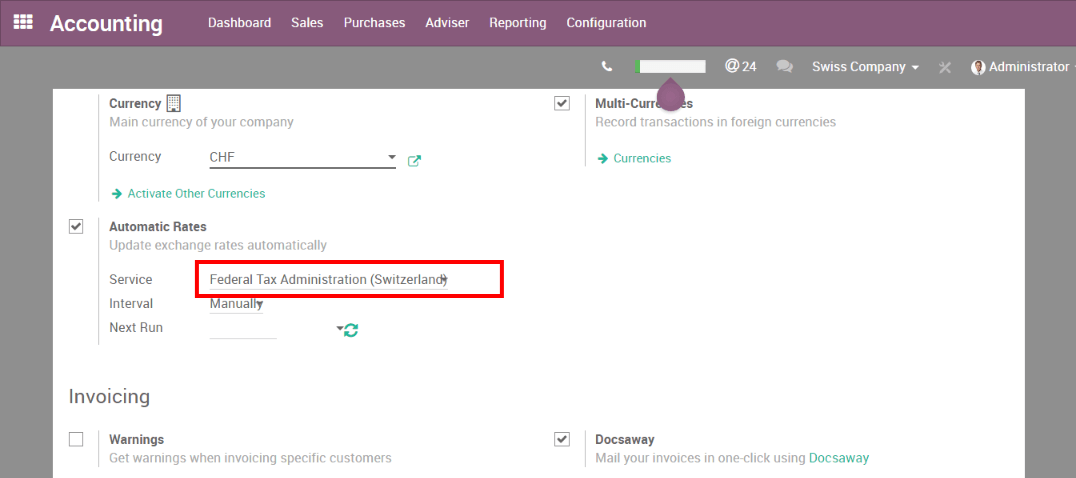

You can update automatically your currencies rates based on the Federal Tax Administration from Switzerland. For this, go in , activate the multi-currencies setting and choose the service you want.

Updated VAT for January 2018

Starting from the 1st January 2018, new reduced VAT rates will be applied in Switzerland. The normal 8.0% rate will switch to 7.7% and the specific rate for the hotel sector will switch from 3.8% to 3.7%.

How to update your taxes in Odoo Enterprise (SaaS or On Premise)?

If you have the V11.1 version, all the work is already been done, you don't have to do anything.

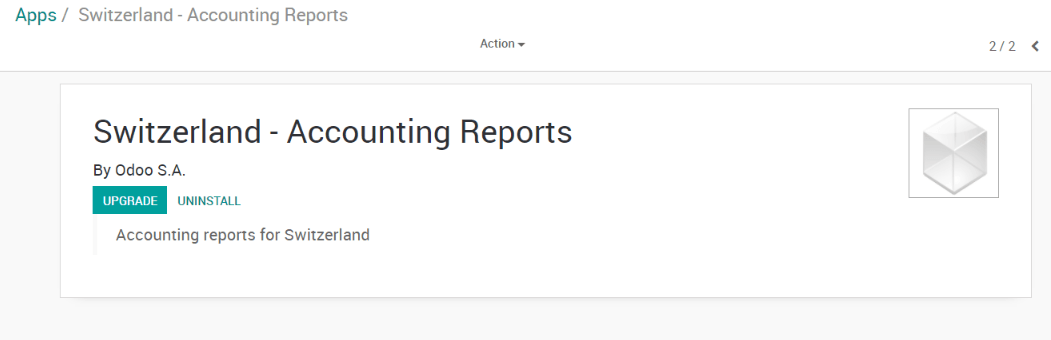

If you have started on an earlier version, you first have to update the module "Switzerland - Accounting Reports". For this, you go in .

Once it has been done, you can work on creating new taxes for the updated rates.

Совет

Do not suppress or modify the existing taxes (8.0% and 3.8%). You want to keep them since you may have to use both rates for a short period of time. Instead, remember to archive them once you have encoded all your 2017 transactions.

The creation of such taxes should be done in the following manner:

- Purchase taxes: copy the origin tax, change its name, label on invoice, rate and tax group (effective from v10 only)

Sale taxes: copy the origin tax, change its name, label on invoice, rate and tax group (effective from v10 only). Since the vat report now shows the details for old and new rates, you should also set the tags accordingly to

- For 7.7% taxes: Switzerland VAT Form: grid 302 base, Switzerland VAT Form: grid 302 tax

- For 3.7% taxes: Switzerland VAT Form: grid 342 base, Switzerland VAT Form: grid 342 tax

You'll find below, as examples, the correct configuration for all taxes included in Odoo by default

| Tax Name | Rate | Label on Invoice | Tax Group (effective from V10) | Tax Scope | Tag |

|---|---|---|---|---|---|

| TVA 7.7% sur achat B&S (TN) | 7.7% | 7.7% achat | TVA 7.7% | Purchases | Switzerland VAT Form: grid 400 |

| TVA 7.7% sur achat B&S (Incl. TN) | 7.7% | 7.7% achat Incl. | TVA 7.7% | Purchases | Switzerland VAT Form: grid 400 |

| TVA 7.7% sur invest. et autres ch. (TN) | 7.7% | 7.7% invest. | TVA 7.7% | Purchases | Switzerland VAT Form: grid 405 |

| TVA 7.7% sur invest. et autres ch. (Incl. TN) | 7.7% | 7.7% invest. Incl. | TVA 7.7% | Purchases | Switzerland VAT Form: grid 405 |

| TVA 3.7% sur achat B&S (TS) | 3.7% | 3.7% achat | TVA 3.7% | Purchases | Switzerland VAT Form: grid 400 |

| TVA 3.7% sur achat B&S (Incl. TS) | 3.7% | 3.7% achat Incl. | TVA 3.7% | Purchases | Switzerland VAT Form: grid 400 |

| TVA 3.7% sur invest. et autres ch. (TS) | 3.7% | 3.7% invest | TVA 3.7% | Purchases | Switzerland VAT Form: grid 405 |

| TVA 3.7% sur invest. et autres ch. (Incl. TS) | 3.7% | 3.7% invest Incl. | TVA 3.7% | Purchases | Switzerland VAT Form: grid 405 |

| TVA due a 7.7% (TN) | 7.7% | 7.7% | TVA 7.7% | Sales | Switzerland VAT Form: grid 302 base, Switzerland VAT Form: grid 302 tax |

| TVA due à 7.7% (Incl. TN) | 7.7% | 7.7% Incl. | TVA 7.7% | Sales | Switzerland VAT Form: grid 302 base, Switzerland VAT Form: grid 302 tax |

| TVA due à 3.7% (TS) | 3.7% | 3.7% | TVA 3.7% | Sales | Switzerland VAT Form: grid 342 base, Switzerland VAT Form: grid 342 tax |

| TVA due a 3.7% (Incl. TS) | 3.7% | 3.7% Incl. | TVA 3.7% | Sales | Switzerland VAT Form: grid 342 base, Switzerland VAT Form: grid 342 tax |

If you have questions or remarks, please contact our support using odoo.com/help.

Совет

Don't forget to update your fiscal positions. If you have a version 11.1 (or higher), there is nothing to do. Otherwise, you will also have to update your fiscal positions accordingly.